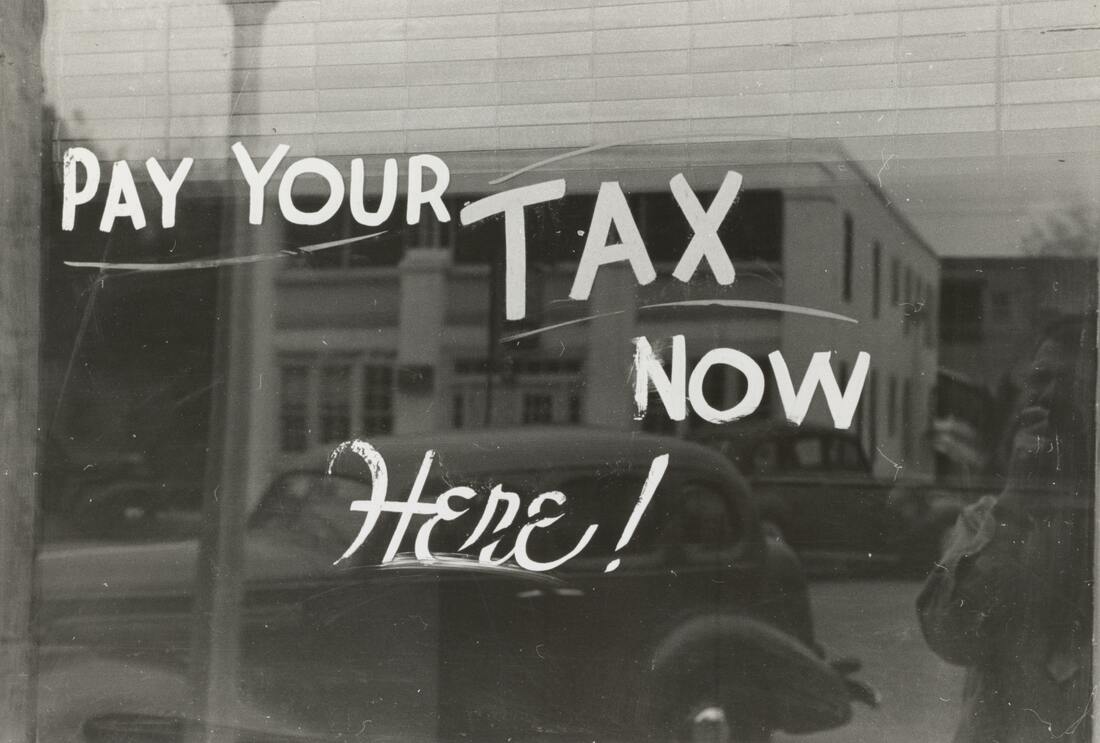

Photo by Fabian Blank on Unsplash | This week the Chancellor delivered his second budget this year – the autumn one is intended to include the tax but as we know Brexit could change it all. It’s usual for some budget policy decisions to be ‘leaked’ before the budget but the press were running some pretty wildly varying theories over the weekend. Let’s see what happened in this "defining moment": |

- Increasing the planned the point at which people pay tax to £12,500 (National Insurance has lower thresholds)

- Increasing Annual Investment Allowance to £1m for 2 years

- Freezing the VAT registration threshold for a further 2 years at £85,000

- Increasing living and minimum wages

- Confirming the planned reduction in Corporation Tax to 17% in 2020

- Confirming major changes to the IR35 regime

The papers which support the budget often contain far more than what is actually said on the day and it is clear that there will be further consultations on VAT and the implementation of the IR35 changes.

I’ve also produced an audio recording of my commentary on the budget!

Don't forget, this newsletter is designed to draw attention to specific topical issues and is in no way intended to provide advice tailored to your business - advice must always be sought before acting on any item featured.

Personal Allowances & National Insurance

Photo by The New York Public Library on Unsplash | The point at which people will pay income tax rises to £12,500 for 2019/20 which is some £650 higher than the current year. From April 2019, spouses and civil partners may transfer £1,250 of their personal allowance to each other. The point at which people pay higher rate tax has risen and will be £50,000 for 2019/20 which is by far the biggest personal tax change. |

- Pay higher rate tax

- Start to lose your child benefit

- Lose some savings allowance

The thresholds at which people pay National Insurance have not risen as significantly so employees and sole traders can still expect to pay National Insurance even if there is no tax to pay. The threshold will be £8,632.

Class 2 National Insurance (at £3 a week) will continue to be collected as part of the Self Assessment process and now will continue as the Class 3 alternative would have been costly to low earners.

Clients working for large organisations through ‘personal companies’ could see a major change in their taxation from April 2020 as HMRC seek to tax them as being employed rather than as a freelancer. These rules were piloted within the public sector this tax year and will be rolled out to larger organisations.

Selling Your Let Property

Photo by Chris Ross Harris on Unsplash | A further change to Capital Gains Tax will be introduced from 2020 whereby you will potentially lose lettings relief on a house you previously occupied and the ‘final 18 month’ rule reduces to 9 months, so people who let their houses out after occupying them and make a significant gain are likely to pay more tax. |

VAT Threshold

Employing People

Photo by Alex Kotliarskyi on Unsplash

Photo by Alex Kotliarskyi on Unsplash The changes are as follows:

- Increase the living wage from £7.83 to £8.21 per hour

- increasing the rate for 21 to 24 year olds by 4.3% from £7.38 to £7.70 per hour

- increasing the rate for 18 to 20 year olds by 4.2% from £5.90 to £6.15 per hour

- increasing the rate for 16 to 17 year olds by 3.6% from £4.20 to £4.35 per hour

- increasing the rate for apprentices by 5.4% from £3.70 to £3.90 per hour

It is important you review all employees on the payroll to ensure you are compliant. With ‘RTI’ payroll reporting in place it would be very easy for HMRC to spot non-compliant employers and indeed a number of businesses have already been fined, named and shamed.

There were changes to Employment Allowance but these are unlikely to affect most clients. It is vital if you are a single director company that you do not claim this (even if HMRC basic tools or your software allows it)as HMRC are now carrying out compliance checks in this area and are set to collect underpaid National insurance.

RSS Feed

RSS Feed